Keeping Books Accurate

By Diane M. Calabrese / Published July 2021

One word: Consistency. If you deviate from a methodical approach to making entries, then inaccuracies will likely accumulate in the books. The hours spent rectifying discrepancies will ultimately be much greater than any time claimed by putting off required entries to devote attention elsewhere.

Careful, timely entries get accuracy off to a good start, but follow-through is just as important. Debbie Ard, the bookkeeper at Bozeman Distributors, Baton Rouge, LA, suggests a few things to keep in mind.

The keeper of books “must make sure everything is posted to the correct general ledger number and that it stays in balance,” says Ard. “These balances must be checked at the end of the month before closing.”

There are many choices in software. “We use industry specific software,” says Ard. “However, I do like QuickBooks®.”

One consternation for those who maintain accounts stems from not being given information needed for entries in the most expeditious way. Paperwork must be submitted in a timely fashion, says Ard. If there seems to be a delay, Ard recommends reminding the party in question. And she recommends doing so persistently enough to get the paperwork.

Marie Reinsel, the executive director of the PWNA and the COO of A2Z Pressure Washing in Bellevue, OH, brings more than 25 years in corporate finance to her roles. Lack of consistency and lack of knowledge are two places where stumbles occur and inaccuracy takes hold, she explains.

One must commit to a routine that ensures accuracy. For example, in addition to consistency in making entries, there should be consistency in reconciling books. Some businesses choose quarterly verifications, but monthly reconciliation may suit many better.

Reinsel also likes much about Intuit’s QuickBooks®. She cites some of the software’s attributes. “You can log into it anywhere,” says Reinsel of the software. “It’s very user friendly. It has a good helpline. You can access it from a phone and issue invoices from a phone.”

Whichever software or cloud vendor a company chooses for bookkeeping, the increasing sophistication in the capabilities will make its product welcome. So will ever-greater simplicity of use.

While all business owners know at their core how essential it is to be consistent in record keeping, some may not realize what they do not understand. Reinsel says she is concerned that most people do not have the knowledge they need to take on all the tasks tied to keeping accurate books.

Records involving taxes and workers’ compensation are “very difficult,” says Reinsel. “I think you need an accountant at least once a year.”

The accountant at the very least can come in to “double-check” books, says Reinsel. But she strongly recommends that every business owner have a regular tie to an accountant.

Many record-keeping requirements are complicated, such as states that require businesses to collect sales taxes on purchases their residents make in whichever state they are made. And tax laws keep changing. Expect 2021 federal (and corresponding) state requirements to be quite different from 2020.

Reinsel says that despite her deep and broad experience in finance, she uses an outside accountant for that crucial double-check both at her business and at PWNA. She recommends all business owners do the same.

Why It Matters

Keeping good records facilitates legal compliance and tax preparation. It also contributes to the ease with which a business can plan.

There’s predictive value in good records. For instance, they make it easy to identify which customers buy more and when they buy. The patterns can inform the approaches to inventory and staffing.

With good records there is nothing onerous about filing quarterly taxes. Trying to reconcile receipts and expenses just in time to meet a payment deadline leads to frustration and possible errors.

With a firm bookkeeping system in place, information required for renewals (e.g., insurance, licenses) is readily available. Bill due dates can also be built into a system.

The number of functions a business owner ties together in one system—and the type of system (e.g., software, cloud-based, hybrid)—requires some thought. Security walls must be established so that an employee taking a customer payment in the field cannot inadvertently access payroll information, for example.

Sole proprietors and small contractors, even those in their first year of business, should not neglect record keeping. A good foundation makes it easier to grow. For one, there’s documentation to show a potential creditor.

The picture a business owner has of assets, liabilities, and equity can be shared with a bank or other lender. Insurers may also want the information.

The more refined the records, the better the analysis that can be made of where to invest. Online sales and in-person sales can be compared. The revenue generated by type of sale can also be tallied.

Suppose a contractor offers several residential cleaning services, such as exterior house, deck, and driveway. If one of the services is dragging down revenue, perhaps it’s time to increase the price or jettison it.

Distributors can evaluate equipment and ancillaries that move quickly and those that do not. Inventory can be reconfigured.

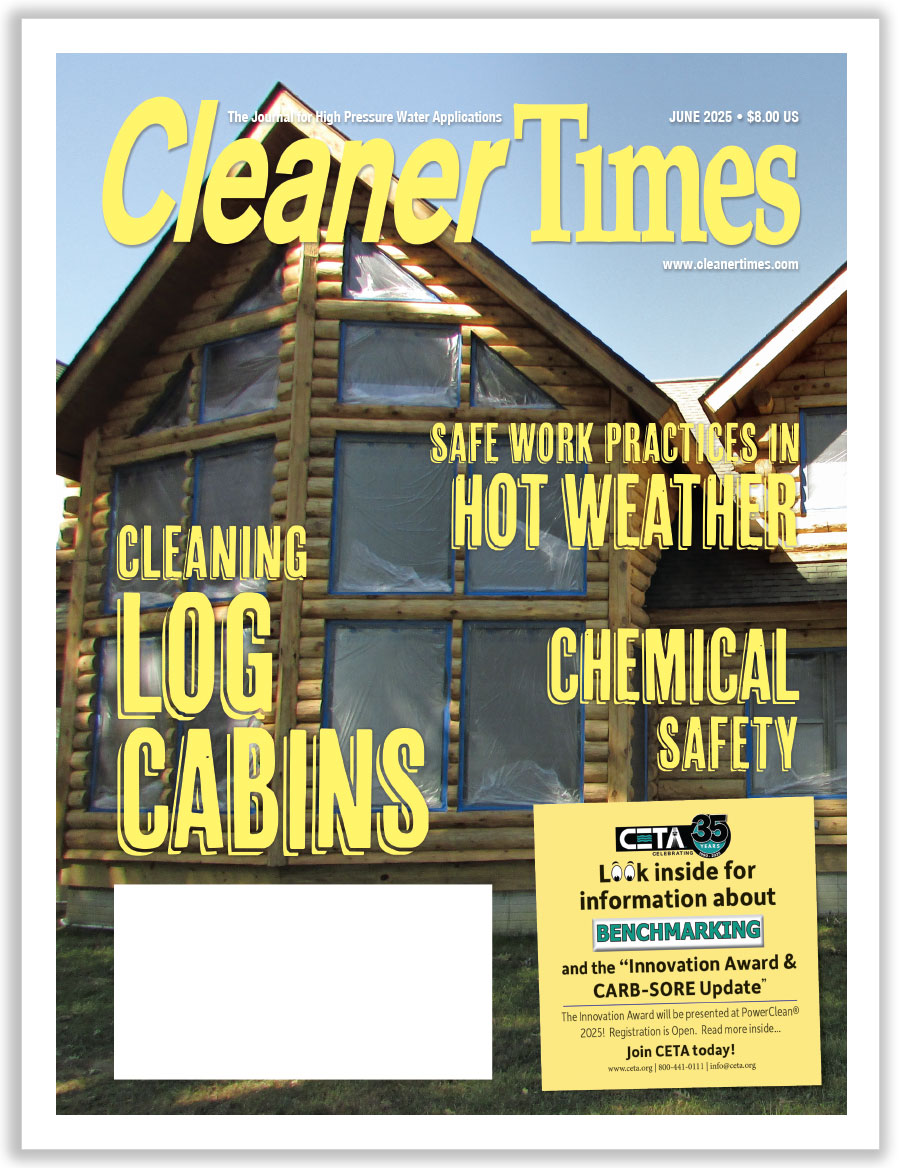

With accurate records, it’s possible to appraise the cost and benefit of every aspect of a business. It’s even possible to compare with other businesses. Companies can participate in benchmarking programs that allow them to critically assess their performance. CETA [Cleaning Equipment Trade Association] offers one such opportunity, which is specific to distributors in our industry who want to evaluate their performance in the context of other distributors.

When setting up a bookkeeping system, a business owner has many decisions to make. (Here, too, is where the advice of an outside accountant helps.) Consider something as basic as whether to use a cash or accrual system.

Cash makes a lot of sense. An entry for payment is made when it is received. If a contractor completes a job in April and receives the payment in May, the entry is made for May.

An accrual method is an alternative to cash method. In short, payment received in May for a job completed in April is recorded for April. The accrual method is more complicated, but it provides a good picture of when revenue is actually generated. And it can reduce quarterly taxes, by preventing a cluster of receipts from boosting a required quarterly payment.

Any company that is serious about bidding on large private or government projects is familiar with GAAP [generally accepted accounting principles]. Some entities that issue RFPs [requests for proposals] specify the type of accounting procedure that a responder or bidder must have in place. Others specify adherence to GAAP.

Every business must have someone in-house who manages the basic functions of bookkeeping. They are receipts (accounts receivable), payments (accounts payable), cash on hand (cash available), and reconciliation (of accounts and with bank reporting). A sole owner/operator will likely take on all tasks and make quarterly tax and other payments.

Yet even the single person owner/operator should invest in the services of a professional accountant at least once a year. It’s a matter of accuracy.

Across the 12 months of the year, the owner of the smallest business should consider hiring a bookkeeper on a part-time basis. Having an individual come in a few hours each week (as an independent contractor) to

keep books frees time for the owner. Professional accountants can often recommend bookkeepers who work as independent contractors.

The U.S. Small Business Administration (SBA.gov) offers many free resources—mentors to webinars—to assist with settling on and consistently using a record keeping system. Take advantage of them.